Chart of Accounts

Always remember to backup often!

Scroll down for Chart of Account Templates you can open and edit with Excel, Google Sheets, text editors and other software.

A bank account and income/ loss account is required for BibsBooks to fully function. First create the two accounts and then set them under Company Details.

Learn more here: Creating a New Company

Chart of Account Types List

Fixed Asset

Other Current Asset

Other Asset

Accounts Receivable

Accounts Payable

Loan

Credit Card

Other Current Liability

Long Term Liability

Equity

Cost of Goods Sold

Expense

Other Expense

Other Income

Non-Posting

BibsBooks Chart of Accounts

If manually adding your chart of accounts:

Click Chart of Accounts on the menu.

Click the + icon in the top right corner to add a new account.

Assign a Chart of Accounts Number, Select the account type, Enter your Bank Account Name. Enter optional tax lines and notes. Click done.

Template .csv files found below can be imported into BibsBooks to help set up a new company.

The tax lines in the csv files are set up using Intuit’s notation which should help if using their tax filing software such as Pro-Connect or Lacerte.

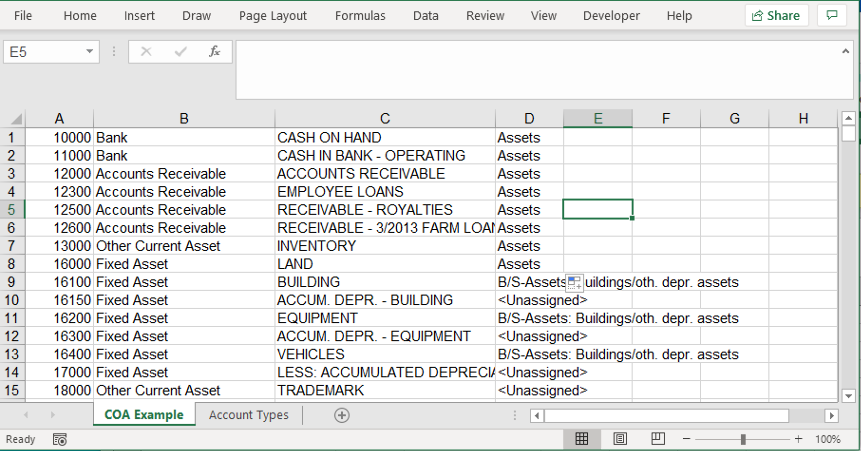

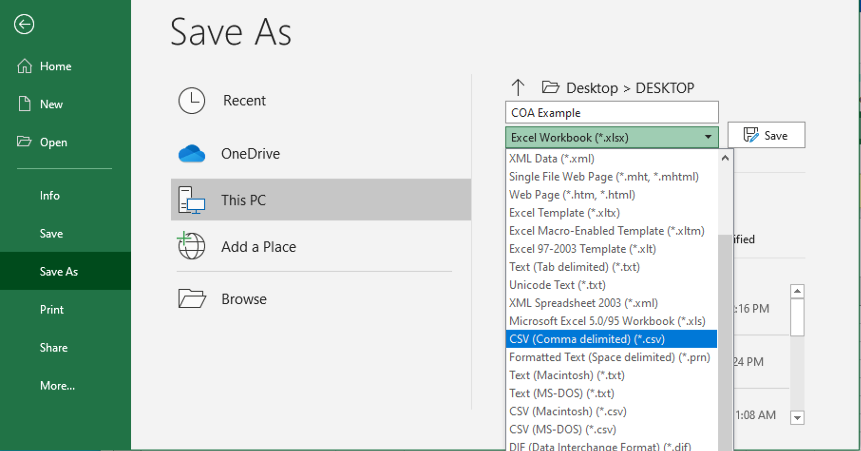

Create a CSV for Importing a Chart of Accounts

If you are using Excel, continue below. If you are using Google Sheets, click here.

- In the first column enter unique account numbers.

- In the second column enter the Account Type. Make sure the spelling and punctuation, including capital letters, is exact when entering the account types.

- In the third column enter the Account Names.

- In the fourth column enter the Tax Lines.

On the BibsBooks menu, click Company Details and import in the CSV you just created!

Please use your regular web browser (i.e. Chrome) to download and save files to your computer!!!

Using BibsBooks help menu will not work.

Chart of Account Templates

It is recommended that you speak with your accountant filing your taxes while creating your chart of accounts! It can save everyone lots of time going forward!!!